Here's an overview of Skrill's fees and charges: Free. Here are the transactions you can do in Skrill for free: Receiving money into your Skrill account; Paying a retailer online that accepts Skrill using your Skrill wallet; Funding your Skrill account (usually free, but other options may charge small fees which will be clearly stated). Welcome to Who Accepts It You can use the name search above or view the categories to find the payment types accepted by companies in the UK. Want to know if Lidl accept Apple Pay, or Amazon take PayPal, you'll find the answers here.

Betting sites with Skrill – Sportsbooks that accept Skrill – Bookieexpert

Skrill is known as one of the primary e-wallets which is widely used in the gambling industry for transferring and storing online gambling winnings Forex trading and social networks. Actually, in its history, the company was initially called Moneybookers, later the gambling community call it as Skrill. Skrill now is available in more than 200 countries and supports 26 currencies and 15 languages.

Thank to its various advantage which is easy to send, accept and store payments to a wide range of countries. Accepting by various Asian leading sportsbook like Dewabet, 12bet credits for Skrill a plus. To compare with other e-wallet, we can say if a business runs is a risky country, or itself already belongs to a risky industry like gambling, adult services, and firearms , they do not have no choice but to go with Skrill as it's better than Payal in terms of professionalism.

So, if you're running a business in a country or industry that isn't supported by PayPal. Skrill starts to look more appealing.

What is Skrill and how can gamblers use it at the bookmakers?

Functioning is pretty much like other leading e-money, like Bank transfer, Skrill is available at all Asian sportsbook and casinos. You can process all transaction liek withdrawing, depositing or transfering. Many gambler prefer to use this e-wallet because of its instant payment policy and low cost of transfer, allowing for very quick deposits and withdrawals.

The most important thing, signing up for a Skill is free of charge, even there is a new update in 2019. To open an account, players need to visit the operator official website and sign up. Then, they will need to fund it via their preferred payment method such as credit cards, bank transfers, bank deposits, etc.

Now let's have a look at what you can do with Skrill

The Skrill Digital Wallet offers you safe, convenient and swift online payments anytime and anywhere. You can:

Send and receive money

Internationally, directly to bank accounts, mobile wallets and other Skrill accounts

- Locally, to friends and family's bank accounts, mobile wallets or Skrill accounts

- to and from various merchants (purchase goods and services, etc.)

Conveniently access your funds with the Skrill card products

- Skrill prepaid Mastercard (plastic)*

- Skrill virtual card

- Buy and sell Cryptocurrencies.

Using Skrill helps you constantly convert 40 fiat currencies to Bitcoin, Bitcoin Cash, EOS, Ether, Ethereum Classic, Litecoin, XLM, XRP and 0x. https://344rostdesur-masv.wixsite.com/softtoys/post/prism-no-deposit-code.

Our very active customers enjoy various and exclusive benefits such as our VIP and Ambassador program.

How to register a Skrill account at betting site

Opening a Neteller account is easy and takes no more than a few minutes. To register and create their own e-wallet, players need to provide their personal information in the registration form. This includes their names, addresses, and birth dates, as well as valid telephone numbers and e-mail addresses. The option for choosing a currency is also available – USD, EUR, GBP, and CAD are among the accepted currencies. The last step is you have to fill out with your address detail and your phone number. After that, there will be an easy CAPCHA challenge question for you. Stick into the box that you agree all the T&Cs of Skrill. Then you get the the final step which is open account.

To open a Skrill account for free, go to their website and follow these steps:

- Enter your email address and create a new password.

- Select Next.

- Fill out your personal details and go to Next.

- Choose your country and the currency for your new Skrill account.

- Fill out your address details.

- Enter your telephone number and complete the captcha challenge question.

- Read the Skrill Terms and Conditions and tick the box if you agree.

- Select Open Account.

Then you have to go through the verification step. There are some changes for better security for you.

Who Accepts Skrill Support

You may also be asked to provide additional information to verify your identity, this may include:

- A color copy of your ID such as identity card, driver's license or passport

- A picture of you holding your identity document next to your face

- A proof of address document like a utility bill or bank statement issued within the last three months

We have a a tip for you, you always have to remember that if you register your Skrill account via eWalletBooster you will receive the following benefits:

- Fast-track verification

- Free Bronze VIP Upgrade

- Average monthly cashback of 0.55%

- $20 Sign up bonus from us

- €100 exclusive Skrill bonus

Skrill VIP Program

To award the most active users, there is VIP for Skrill user. To become a Skrill VIP you must simply use your Skrill wallet by transacting to merchants or by buying or selling Crypto. The minimum amount to be transacted is of €6.000 (or the equivalent in your chosen currency) for a quarterly period.

The day after you reach the minimum transfer criteria, your account will automatically become a Skrill VIP account. You are then guaranteed the VIP status for the rest of that quarter and the following quarter.

Becoming a VIP Skrill can bring to you a lot of benefits:

- Priority bank uploads and higher limits on your transactions – both online and offline (using your Skrill card).

- Multi-currency account (VIP Silver and above)

- Access to help 24 hours a day. Silver members and above also have a personal account manager.

- As a VIP member, you will enjoy reduced fees for your transactions. The more you use your Skrill wallet, the less you will pay.

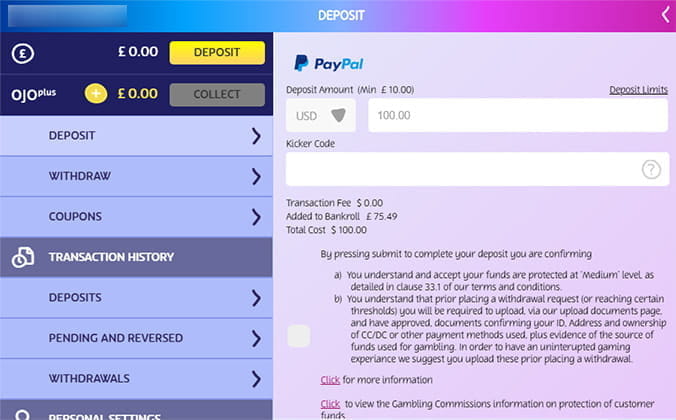

Depositing and withdrawing at Online betting sites via Skrill

Because of its convenience and high level of security, Skrill is preferred by many gamber in Asia.

The process is pretty easy, after you visit the Asian sportsbooks that you want to deposit, then you choose it as a deposit option and enter Skills ID and the password. The process takes no more than 1 minute.

Withdrawal: The process is equally easy – you need to visit the Banking or Cashier section, choose Skrill as a withdrawal option, and enter your ID and password. Confirm the transaction after selecting the amount of money you wish to transfer from your casino balance to the e-wallet.

What Fees Does Skrill Charge?

One of the most important factors that will determine whether or not Skrill is right for your needs is fees. This doesn't just come in the form of transfer fees, but also the costs associated with depositing and withdrawing funds, as well as currency exchange fees. We've broken the fees down in more detail below. Big wins at the casino.

We will include for you in this table

Deposit Fees

All payment carry a fee of 1% ( your balance will be subtracted as soon as you deposit

Withdrawal Fees

Your personal bank account: 5.50 EUR

Visa debit/credit: equivalent 7.5%

Transfer Fees

They will charge you up to 1,45% for each transaction.

Skrill Customer Support

If you need assistance with your Skrill account, it is always worth checking their extensive FAQ section first that you can browse such a Account category or Prepaid card from different sections. We found that most account queries can be solved by reading the many help guides on offer. However, if you need to speak with the Skrill team directly, then you have a couple options at your disposal.

If you have any questions about your account or need help, please visit their help hub.

Alternatively, you can send us an email at [email protected] or call us on one of our international toll-free numbers.

International number: +44 203 308 2520.

Why should Asian gamblers use Skrill

- Instant withdrawals – try withdrawing funds over the weekend and you can get frustrated with other online payment providers and e-wallets.

- Other than instant withdrawals, Skrill account holders also enjoy low withdrawal fees.

- Skrill provides its users with exclusive offers. These specialized offers are arranged with bookmakers in Asia

- They also furnish you with a bank card which you can use as travel money and top up/withdraw your funds. You can also use this card to pay selected retailers and product partners.

- Skrill has supported customer service and support. They have varying support tiers which include an FAQ section on their site, email support, and voice support

- You won't get locked out of your account for no reason at all, unlike some e-wallets in the industry.

- Skrill is recognized and accepted across the world including the Philippines.

- The company also furnishes its customers with a monthly statement, which is great for those who want to keep track of their expenses

Skrill is one of the most popular payment sites and it has a competitive edge over other payment sites such as Payza and PayPal. The reach of this site is mainly because of the fact that, it operates in more than 200 countries and is operating financial dealings using over 40 currencies worldwide. Using Moneybookers, which is now known as Skrill, the user would be able to perform all their financial transactions involving online purchases, credit or debit card transactions and even transfer money across the world. By signing up with one particular payment managing website, the user would be able to create a personalized wallet with the VPN service and this can be used to transfer money. Skrill is not only used by individuals, it is also used by businesses to perform financial transactions. Thus, it acts as a complete business and personal financial solution.

Financial management would play a key role for both individuals and businesses. Security is the prime factor to be considered when performing financial transactions. https://nesyldecess1976.wixsite.com/flodownload/post/voxengo-ovc-128-1-4-download-free. Skrill offers the highest level of secured financial transaction to its users.

Skrill for VPNs

VPN subscribers are growing in numbers as we speak and in order to subscribe for a reliable VPN service, the user should make payment to the company. Most of the VPN companies offer different payment methods. The users would be able to make the payment directly using their credit cards or debit cards and even using payment platforms such as Liberty reserve, PayPal, Payza and Skrill etc. The security offered by these payment platforms would be much higher than the traditional methods of making direct payments using the credit or debit card. Skrill would be the preferred choice for most of the subscribers since most of them would have been maintaining an account in Skrill for performing online transactions.

Choose the VPN first

Those who are about to subscribe with a VPN service should first take into consideration, mainly the service offered by the VPN provider and not choose them based on payment method alone. Signing up for a VPN service based on the payment method is not the right way because one might end up signing up with a poor VPN service provider. Services should be chosen based on the cost, type of service offered and even based on the history of service quality provided by the VPN. Thus, the best way would be to sort out the list of those who are offering their payment based on Skrill and among them, the user should select the best VPN service.

Secured payment method

Skrill is a secured payment method and users can be sure about the security level and need not worry about the risk of losing their money. VPNs that offer a secured payment method can be easily identified using the Standard secured symbols or logos which would be displayed on their website. E-Trust, e-verify and other verification agreements should be displayed on the website which manages a financial transaction. In order to obtain these security certificates, companies would be tested on all grounds by the concerned authorities. Thus, to be on the safer side, the subscriber should make sure that they opt for the one that has been approved under these certifications.

Best VPN payment through Skrill

Our experts have tested the services offered by VPN providers who support Skrill based payment method and have provided a list of the best VPN providers from which, the user can choose one particular VPN provider.

Who Accepts Skrill Bank

| Rank | Provider Name | Starting Price | Money Back Guarantee | Visit Provider Site |

| ExpressVPN | $6.67/month | 30 Days | ||

| 2 | IPVanish | $10.00/month | 7 Days | |

| 3 | Hidemyass | $11.52/month | 30 Days | |

| 4 | VyprVPN | $10.00/month | 7 Days | |

| 5 | StrongVPN | $21/ 3 months | 7 Days |